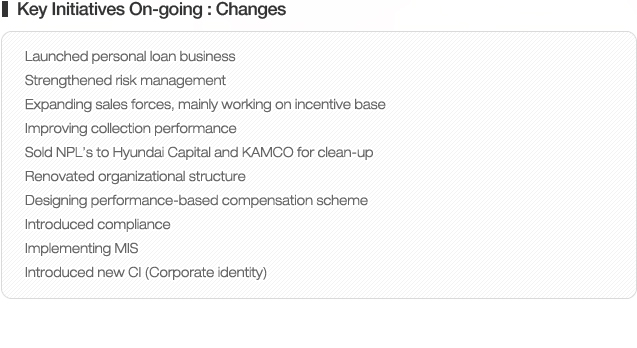

Key Initiatives On-going : Changes

Launched personal loan businessStrengthened risk management

Expanding sales forces, mainly working on incentive base

Improving collection performance

Sold NPL’s to Hyundai Capital and KAMCO for clean-up

Renovated organizational structure

Designing performance-based compensation scheme

Introduced compliance

Implementing MIS

Introduced new CI (Corporate identity)

| 2011.6 | 2012.6 | 2013.6 | |

|---|---|---|---|

| Net income(KRW billion) | 20 | 417 | 87 |

| ROE | 1.41 | 28.93 | 4.76 |

| ROA | 0.08 | 1.60 | 0.32 |

| BIS ratio | 9.26 | 10.18 | 10.01 |

| NPL ratio | 10.82 | 12.69 | 11.89 |

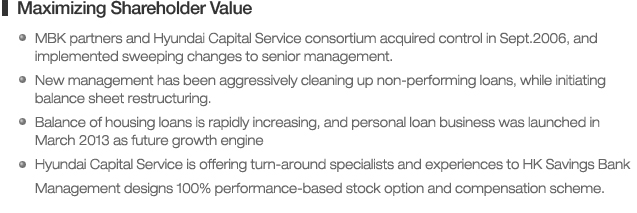

Maximizing Shareholder Value

- MBK partners and Hyundai Capital Service consortium acquired control in Sept.2006, and implemented sweeping changes to senior management.

- New management has been aggressively cleaning up non-performing loans, while initiating balance sheet restructuring.

- Balance of housing loans is rapidly increasing, and personal loan business was launched in March 2013 as future growth engine

- Hyundai Capital Service is offering turn-around specialists and experiences to HK Savings Bank Management designs 100% performance-based stock option and compensation scheme.